Buying a Convenience Store

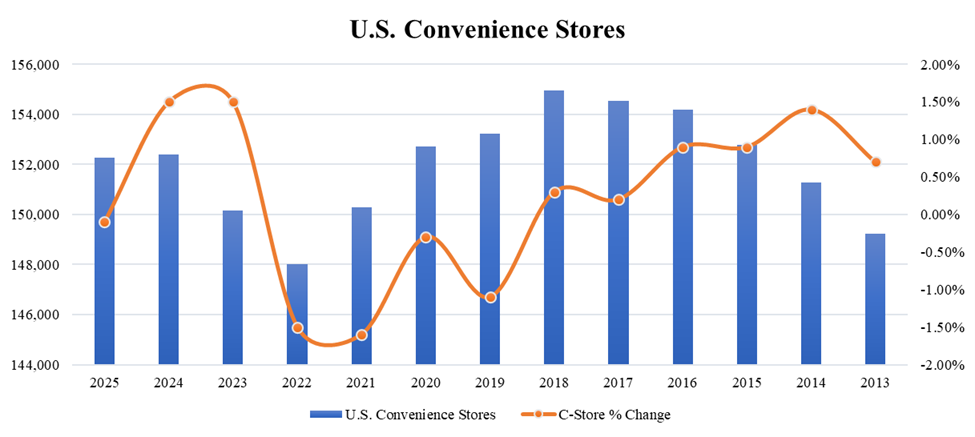

According to the National Association of Convenience Stores (NACS), the United States is home to 152,255 convenience stores. Furthermore, 80% (or 121,852) sell motor fuel and 60% (or 91,353) are single store operators. The top three states that have the most convenience stores are Texas, California, and Florida.

* National Association of Convenience Stores. (2025). U.S. convenience store count. Convenience.org. https://www.convenience.org/Research/Convenience-Store-Fast-Facts-and-Stats/FactSheets/IndustryStoreCount

Convenience stores are strategic places to serve tourists at all times of the day as a needed place to rest, fuel up, and grab food. Furthermore, for locals, they are the very place that make up the fabric of their communities. A place to grab coffee and say hello to your neighbors and even a place where your children get their first job.

It should not be a surprise that when 60% of convenience stores are single store operators, buying one more is a great opportunity for operators to grow their footprint.

As convenience store advisors, here is a pro-tip to stay ahead of your competition, understand the why behind the seller’s decision to sell. Your competitive advantage of beating out the big guys is being a family business. While others come into the situation with ‘smoke and mirrors’, you can come in from an angle of understanding family business dynamics and wanting to take care of the reputation built. Here are some of the reasons why convenience store owners are selling:

- No Succession: Family business owners have determined that their children are not prepared to take over the business, do not want to take over, or they do not have anyone to take it over.

- Market Volatility: After decades of seeing the volatility with supplier pricing and interest rate fluctuations owners have determined it is time to start the next chapter.

- Tough Labor Market: Finding A+ employees can be tough, especially if you’re in a small rural town. Owners have decided they no longer want the headache.

If you are looking to complete your first convenience store acquisition or tenth, it serves as a great opportunity to grow! Here are three quick benefits:

- Grow your local market share (Increase sales and profits)

- Expand into a new market

- Diversify to a new product

As convenience store acquisition advisors, we know there is more than meets the eye when seeking to make your next acquisition. Let’s talk about some key value drivers for convenience stores:

- Location: Is the convenience store located in an urban, suburban, or rural location?

- Accessibility: Is the store located at a controlled intersection? Highway exit? Main road access?

- Customer Demographics: Are the products and services aligned with the neighborhood demographics?

- Visual Appeal: Does the store (on the outside and inside), pumps, and canopy appear in good condition? Is the lot paved over without significant ‘pot-holes’?

- Branded or Unbranded Fuel: Is this your fuel brand or a different one? Or do you want to remain unbranded?

- Safety and Compliance Records: What is the status of these records that can be provided?

- Team Member Stability: What is the tenure of the team members?

Again, whether you are looking to make your first convenience store acquisition or your tenth, getting a business valuation for the convenience store acquisition just makes sense. As M&A advisors, we understand that when another advisor reaches out to you, they might provide you with a Confidential Information Memorandum, a package of information about the business opportunity. Again, Meridian can walk you through that documentation, prepare a business valuation, and even provide a list of clarifying questions based on the information initially provided. You want as much clarity as possible before you submit an offer, so you have an edge.

If you are looking to make a convenience store acquisition, here are just some of the things you should consider reviewing:

- “True” Earnings: Do not be fooled by unjustified adjustments or non-recurring income.

- Seasonality: Some stores are affected more by summer (or even winter) travel season than others.

- Brand Contract: If there is a contract, how long is left? What are the minimums? Is there a right of first refusal (ROFR)?

- Company Culture: What is the tenure of the employees?

- Environmental: What do the historical environmental records tell you? Consider obtaining Phase I and Phase II studies.

As convenience store acquisition advisors, we understand that it can become overwhelming fast when you consider “what is a fair offer?”, add a short timeframe, and mix in 4 other companies competing to win.

At Meridian our 2nd core value is Simplify. As M&A advisors we simplify the complex. A convenience store business valuation is the best first step to get prepared for the nuances of the new potential operation and the acquisition process. I want to encourage you to reach out to Meridian so our M&A advisors can help bridge the gaps you might be missing and talk about next steps.